MRDP Filings: A Technical Guide for Digital Platforms Navigating HMRC Compliance

The UK’s Model Reporting Rules for Digital Platforms (MRDP) mandate rigorous reporting for businesses facilitating third-party sales. While the first reporting deadline (January 31, 2025) has passed, compliance remains critical for ongoing operations. For food delivery franchises, e-commerce marketplaces, and gig economy platforms, MRDP is not a one-time obligation—it’s a recurring requirement demanding robust systems to collect, validate, and submit seller data to HMRC.

At Barrett Solutions, we can help with MRDP compliance for digital platforms, designing secure systems that transform complex tax reporting into a streamlined process. Our custom-built reporting portals and automated validation tools are engineered to safeguard your business against penalties while ensuring operational continuity.

Understanding MRDP’s Technical Challenges

MRDP requires platforms to collect seller data (names, addresses, tax IDs, transaction histories), validate it against official records, and submit reports in XML format using HMRC’s schema. Despite the first deadline passing, many businesses still struggle with compliance due to:

HMRC’s XML schema guidelines lack detailed examples, particularly around nested elements like DocumentIDList or error resolution workflows.

Ensuring the accuracy and required format of extensive seller details (names, addresses, tax IDs, transaction values) before submission presents a significant challenge, demanding robust internal validation logic and checks, as standard tools often lack these granular capabilities for HMRC’s specific needs.

Franchise models need secure, segregated logins for licensees while maintaining centralised oversight—a feature absent in generic accounting software

Even minor deviations in XML structure can lead to rejected submissions, requiring iterative testing.

Struggling with HMRC’s XML schema or seller data validation? Our team specialises in translating complex requirements into seamless workflows. Contact Barrett Solutions at info@barrettsolutions.co.uk to automate your MRDP reporting.

Building a Secure MRDP Portal for a Food Delivery Franchise

A long-term client operating a franchise-based food delivery platform faced a crisis: With two weeks remaining before the deadline, their franchisees lacked a unified system to submit seller data. HMRC’s sparse documentation left them grappling with XML validation, data mapping errors, and insecure manual processes.

A long-term client operating a franchise-based food delivery platform faced a crisis: With two weeks remaining before the deadline, their franchisees lacked a unified system to submit seller data. HMRC’s sparse documentation left them grappling with XML validation, data mapping errors, and insecure manual processes.

Barrett Solutions’ Technical Response

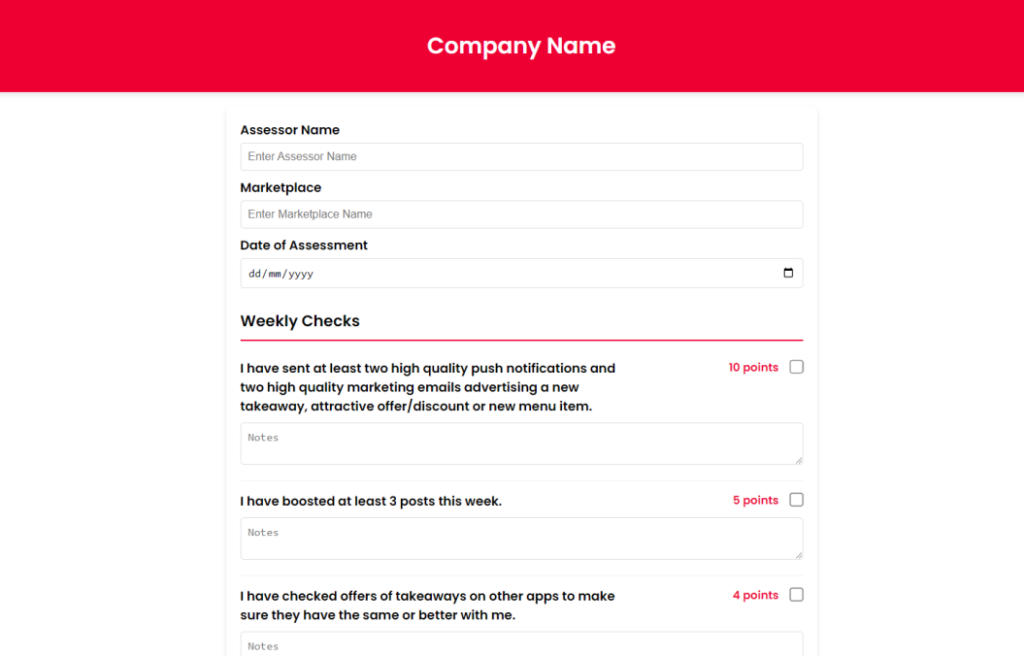

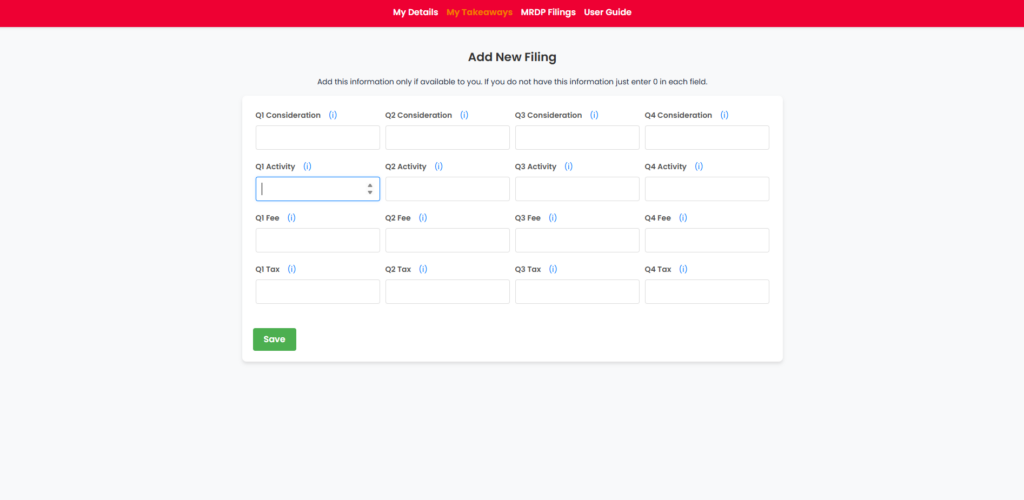

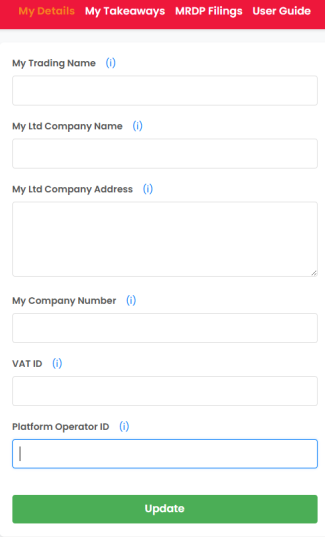

- Built a lightweight, standalone portal with role-based logins. Franchisees access only their seller data, while franchisors monitor submissions in real time.

- Embedded inline validation to flag missing fields (e.g., incomplete tax IDs)

- Designed step-by-step input forms with tooltips explaining HMRC’s vague terms (e.g., defining “platform operator” vs. “seller” roles).

- Added a document upload feature for franchisees to attach supporting files (e.g., signed seller agreements).

- Mapped user inputs to HMRC’s XML schema, generating pre-validated files.

- Conducted rigorous internal testing using mock data to identify potential schema mismatches based on HMRC’s guidelines before attempting the live submission.

Created audit trails to track edits and ensure GDPR compliance.

The solution delivered immediate and long-term value: All franchisees successfully submitted compliant reports ahead of HMRC’s deadline, eliminating the risk of penalties. Crucially, the XML files generated by the system passed HMRC’s validation checks on the first submission—a critical win given the complexity of the schema requirements. Beyond meeting the urgent deadline, the custom-built portal now serves as a scalable foundation for future reporting cycles, enabling the franchise to adapt effortlessly as HMRC refines its guidelines or expands reporting obligations.

Facing tight deadlines or incomplete seller data? Learn how we helped a UK franchise meet HMRC’s MRDP requirements in just two weeks. Email info@barrettsolutions.co.uk or fill out or contact form

Broader Implications for Digital Marketplaces

MRDP applies to any platform enabling third-party sales, including:

- E-commerce giants (e.g., eBay, Etsy)

- Rental platforms (e.g., Airbnb, equipment leasing marketplaces)

- Freelance/gig economy apps (e.g., Upwork, delivery services)

For example, an online marketplace with hundreds of sellers must aggregate transaction data across vendors, validate tax IDs, and format reports to HMRC’s specifications. Manual processes are unsustainable at scale, risking errors, delays, and penalties.

Core Components of an MRDP-Compliant System

A robust compliance system requires four key elements:

Ensures adherence to HMRC’s schema, even as requirements evolve.

Incorporates sophisticated internal checks to verify data formats, completeness, and logical consistency prior to generating the final XML report, minimising rejection risks.

Provides role-based logins for franchisees or sellers without exposing sensitive data.

Tracks submission failures, helping businesses quickly resolve issues like schema mismatches or missing fields.

Why Off-the-Shelf Tools Fall Short

Generic accounting software often lacks the precision needed for MRDP. For instance, most tools cannot map nested XML structures required by HMRC or handle multi-tenant access for franchises. Custom solutions are essential for businesses with complex seller networks or hybrid operational models.

How IT Specialists Enable Cross-Industry Compliance

Technical experts bridge the gap between HMRC’s requirements and a business’s operational reality by:

- Integrating Legacy Systems: Extracting seller data from outdated POS systems or spreadsheets and transforming it into MRDP-compliant formats.

- Simplifying Complex Workflows: Designing intuitive interfaces for non-technical users, reducing training time and errors.

- Future-Proofing Architecture: Building adaptable systems that accommodate HMRC schema updates or expanded reporting needs.

Preparing for Future Reporting Cycles

Businesses that missed the first deadline—or struggled to comply—should prioritise:

- System Audits: Identify gaps in data collection, validation, and reporting.

- Automation Investment: Manual processes are error-prone for platforms with 50+ sellers.

- Proactive Testing: Use HMRC’s test environment to validate submissions months in advance.

Barrett Solutions: Secure, Scalable MRDP Compliance

We specialise in custom systems for digital platforms, including:

- Tailored Reporting Portals: Lightweight web apps for franchises or sellers.

- End-to-End Encryption: Protect data without compromising usability.

- Ongoing Support: Monitor submissions and adapt to regulatory changes.

Ensure Future Compliance

MRDP compliance doesn’t have to disrupt your operations. From custom web apps to secure multi-tenant portals, Barrett Solutions ensures your submissions meet HMRC standards—now and in future cycles. Start streamlining your reporting today: info@barrettsolutions.co.uk or complete our contact form.

Beyond the Expense Line: How Strategic IT Investment Fuels UK SME Growth

UK SMEs: IT investment as a growth engine, not a cost. Frameworks for ROI on managed IT, bespoke systems, web dev & more. Barrett Solutions.

Is Your ‘IT Guy’ Actually Holding Your Business Back? Signs You’ve Outgrown Basic Break-Fix Support

Is your ‘IT guy’ holding your UK SME back? Learn signs you’ve outgrown break-fix IT support & need a holistic, proactive tech partner like Barrett Solutions.

Cheap Website, Costly Mistake? Uncovering the Hidden Price for UK SMEs

Discover the hidden costs of cheap websites for UK SMEs: poor UX, bad SEO, security risks & more. Invest in value, not just a low price. Barrett Solutions.

Beyond Inflated Ad Spend: Why True Digital Success Demands Technical Expertise (And How to Spot Agencies Falling Short)

Spot marketing agency red flags (no tech focus, vanity metrics). Learn why technical expertise boosts ROI. Barrett Solutions integrates tech & marketing.